Global

EU Schengen visa: European Union made major changes in the Schengen visa rules for Indians, know who can apply

Most popular

Lara Dutta reacted to PM Modi’s Muslim quota statement: Said in support – ‘It is difficult to keep everyone happy, he is also a human being’

Lara Dutta: Actress Lara Dutta has been away from films for a long time. However, …

Hema Malini: Dharmendra did not approve of Hema Malini’s entry into politics, the actress did this work on the advice of Vinod Khanna

Hema Malini: Veteran Hindi cinema actress Hema Malini is now mainly active in politics after …

Varun Dhawan Birthday: Varun Dhawan turns 37, cuts birthday cake with mother, shares photos of celebration

Varun Dhawan celebrates 37th Birthday: ‘Bollywood’s handsome hunk actor Varun Dhawan, who has given hit …

Yuvika-Prince Narula: Yuvika Chaudhary is not pregnant! On the rumours, she said- ‘We want a child, whenever it happens, we will inform the world ourselves’

Yuvika Chaudhary denise pregnancy Rumors:The news of TV actor Prince Narula, winner of the 9th …

Vicky Kaushal: Pictures of Vicky Kaushal’s new look leaked from the set of ‘Chhaava’, the actor seen in the avatar of Chhatrapati Sambhaji Maharaj.

Vicky Kaushal new look:After the success of the film ‘Sam Bahadur’, now actor Vicky Kaushal …

Arti Singh Wedding: Aarti Singh’s sangeet ceremony was fully decorated, members of Bigg Boss 13 including ex-lovers Paras-Mahira were seen.

Arti Singh Wedding: TV actress Arti Singh, niece of actor Govinda and sister of famous …

World Book Day: Apart from career, the habit of reading books is also important for health, let’s make friends with books again.

World Book Day: Three decades ago, in 1995, UNESCO in Paris announced celebrating April 23 …

Foreign blogger came to India, drank mud in the Himalayas and said – tastes like masala tea; Video

Tea was not invented in India, but it is the national drink of India. Go …

‘Dil Sambhal Ja Zara’… Boy sang song in Arijit Singh’s voice, won the hearts of fans

Arijit Song dil sambhal ja jaara: Arijit Singh is one of the most famous singers …

Indian Railway: Who saves more between red and blue coaches, know the features here

Indian Railway: Indian Railways is the fourth largest rail network in the world. Passengers travel …

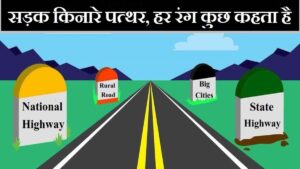

Road Identification: What is the meaning of road milestones, know about all colored stones

Milestones: If you too must be traveling from one place to another, then you must …

Mata Rani Bhajan: You called me Sherawali, let’s come, the call has come, mother has called; See Mata Rani’s bhajan collection here

Mata Rani Bhajan Lyrics Hindi: The holy festival of Navratri is very special for the …

Zucchini Benefits: This cucumber-like vegetable has tremendous properties, reduces cholesterol and blood sugar, know 5 benefits.

Zucchini Benefits: By looking at zucchini, you can mistake it for cucumber or ridge gourd. …

Sugarcane Juice: Sugarcane juice fills you with energy by reducing body heat, know when is the best time to drink it?

Sugarcane Juice Benefits: During summer, sugarcane juice shops are seen everywhere. As soon as you …

Walnut Benefits: Eat soaked walnuts in summer, heart and mind will be healthy; You will get 7 big benefits

Walnut Benefits: It is important to take special care of health during summer. Eating soaked …

Vitamin For Bones: Deficiency of this vitamin makes bones hollow, immunity becomes weak, make up for the deficiency with 5 things.

Vitamins For Bones: To keep the body strong, it is important to have adequate amount …

Healthy Foods: You run out of strength even after walking a hundred steps, fatigue and weakness take over, if you eat 5 things all the problems will go away

Healthy Foods: Most of the people have lost their fitness due to irregular lifestyle and …

Yogasana For Height: Troubled by short height, 3 Yogasanas can help in increasing height, know the method of practice.

Yogasana For Height: Short height becomes a reason for inferiority complex for many people. If …