Global

The biggest robbery in history in Canada: 5 arrested including 2 Indians, know how gold worth 20 million dollars was looted

Most popular

Anupama Spoiler 19 April: Anupama will be badly trapped in the file round of superstar chef, will Anuj be able to support?

Anupama Spoiler 19 April: In the TV serial ‘Anupama’, some problem or the other comes …

VIDEO: Shilpa Shetty reached to meet Salman Khan amid ED action on Raj Kundra, inquired about the condition of the family after the firing incident.

Shilpa Shetty Meets Salman Khan:The recent incident with Bollywood superstar Salman Khan and his family …

VIDEO: After watching the film, Amar Singh Chamkila’s first wife hugged Diljit Dosanjh, Gurmail Kaur was seen in public for the first time.

Amar Singh Chamkila First Wife:Punjabi singer and actor Diljit Dosanjh is very popular these days. …

Salman Khan House Firing Case: Why were bullets fired outside Salman Khan’s house? Shocking revelation made during interrogation

Salman Khan Galaxy Firing Case: The issue of firing outside the house of Bollywood’s most …

ED Action On Raj Kundra: ED action on Shilpa Shetty’s husband Raj Kundra, property worth Rs 98 crore seized in Bitcoin ponzi scheme scam

ED action on Raj Kundra:The Enforcement Directorate i.e. ED has taken major action against Raj …

Arti Singh: Arti Singh reached Kashi Vishwanath to seek blessings of God with wedding card, photos of the actress surfaced in red dress.

Arti Singh:Well-known small screen actress and niece of Bollywood industry’s popular star Govinda, Aarti Singh …

Foreign blogger came to India, drank mud in the Himalayas and said – tastes like masala tea; Video

Tea was not invented in India, but it is the national drink of India. Go …

‘Dil Sambhal Ja Zara’… Boy sang song in Arijit Singh’s voice, won the hearts of fans

Arijit Song dil sambhal ja jaara: Arijit Singh is one of the most famous singers …

Indian Railway: Who saves more between red and blue coaches, know the features here

Indian Railway: Indian Railways is the fourth largest rail network in the world. Passengers travel …

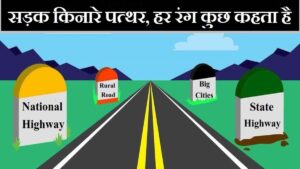

Road Identification: What is the meaning of road milestones, know about all colored stones

Milestones: If you too must be traveling from one place to another, then you must …

Mata Rani Bhajan: You called me Sherawali, let’s come, the call has come, mother has called; See Mata Rani’s bhajan collection here

Mata Rani Bhajan Lyrics Hindi: The holy festival of Navratri is very special for the …

Child Cricket: 3 year old girl hits brilliant cricketing shots on the nets, user calls her ‘future Smriti Mandhana’

3 year old girl playing cricket:There is craze for cricket in India. Today youth are …

Home Remedies: Stinging and burning heat rashes have troubled you in summer, try these home remedies; you will get relief soon

Prickly Heat Home Remedies: As the heat increases, many people start facing the problem of …

Health Tips: 4 bad habits can make you old before your age, at the age of 40 you will become like 80 years old, it is better to leave them

Health Tips: Every person always wants to keep himself young, but when it comes to …

Fruits for Skin: To keep the skin young in summer, consume 5 seasonal fruits, the glow of the skin will remain intact.

Fruits for Skin: It can be difficult to keep skin young and healthy in summer. …

Healthy Bone: If you want to give steel strength to your bones then eat 5 foods, bones will remain strong even in old age.

Foods for Healthy Bones: Whatever be the age, everyone wants to maintain the steely strength …

Snoring Causes: Why do we snore? Are you also troubled by this problem? Know important things related to this

Snoring Causes: The problem of snoring during sleep can be seen in every fourth person. …

Pranayama Benefits: If you are troubled by stress and anxiety then do Pranayama daily, this yoga asana gives stability and strength to the mind.

Pranayama Benefits: Pranayama is a yogic activity, doing which gives great benefits to the body. …